In a blow to working people and small businesses across the Bridgwater Constituency, Labour's first budget under Chancellor Rachel Reeves delivers a host of broken promises and an unprecedented increase in the tax burden.

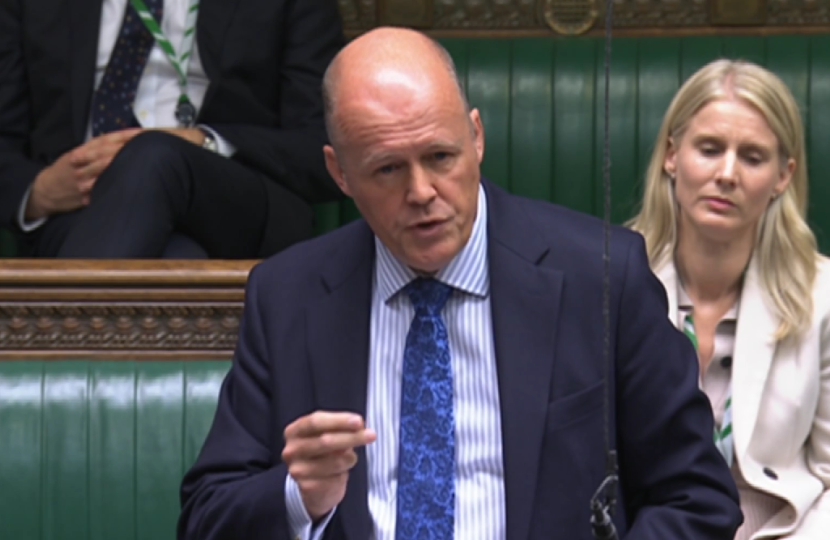

I am deeply concerned about the impact of this Budget on local businesses and workers. This Budget does more than raise taxes; it strikes at the heart of our local economy. Businesses, particularly small employers, will now face higher National Insurance costs, making it harder for them to invest, expand, and retain their workforce. Labour's tax hikes are set to make operating and hiring in our communities more costly, placing an unfair burden on hardworking business owners and putting jobs at risk. The ripple effect on local workers is clear – they will bear the brunt of these taxes, with reduced job security and lower real wages.

The Office for Budget Responsibility (OBR) confirms that this tax increase, combined with a massive increase in borrowing, will have a big impact on the UK economy. Labour's Budget pushes the tax burden to a record high of 38.2% of GDP by 2028-29, surpassing levels seen even during the post-war era. The effects are expected to drive up inflation, with the OBR forecasting a sustained increase, ultimately reducing growth and living standards across the board.

With the rise in employer National Insurance contributions and the reduction of the threshold from £9,100 to £5,000, small businesses and lower-income employees will face disproportionate hardship. Leading economic experts at the Institute for Fiscal Studies have voiced concerns that these measures will hit small employers hardest, likely resulting in job cuts and further strain on workers' wages.

Labour's Budget of broken promises will disappoint business owners and workers across the Bridgwater Constituency - raising taxes, increasing borrowing, and risking economic stability.